When is a provision needed, when is a value adjustment necessary?

Contact

Öffnungszeiten:

Monday to Friday

08.00 - 12.00 h / 13.00 - 17.00 hFernsupport durch Caminada:

First of all, it is important to know the definition of provisions, value adjustments and contingent liabilities:

Provisions are liabilities for liabilities that are burdened with an uncertainty regarding the amount and/or the timing of their maturity.

Provisions are, for example:

Provisions no longer required do not have to be reversed in commercial law (Art. 960e para. 4 CO). These must be assessed individually for tax purposes.

Value adjustments are value corrections that relate to asset losses. Frequently occurring examples are the third of goods or the del credere.

Contingent liabilities (Art. 959c para. 2 item 10 CO) represent possible liabilities from a past event. The existence of the liability must first be confirmed by a future event. The risk of a contingent liability is considered to be rather unlikely, so this is not taken into account in the balance sheet, but must be disclosed accordingly in the notes.

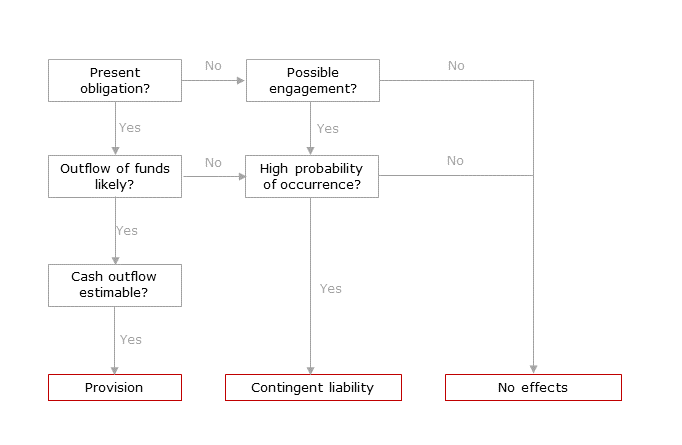

The following decision tree will help you to decide whether it is a liability or a disclosure of the contingent liability in the notes.

Although the existence of an obligation is possible, there is only a remote possibility and an outflow of funds is extremely unlikely. In this case, neither recognition as a provision in the financial statements nor a note in the notes is required.

A future outflow of funds is quite possible, but either unlikely or - although probable - not sufficiently reliably assessable. This is a contingent liability, which must be disclosed in the notes at an estimated amount.

If the outflow of funds is probable and can be estimated reliably enough, a provision must be set up in the balance sheet.

If the clarifications show that a liability exists, it is to be recorded at nominal value.

Value adjustments can have a real or also a tax background. We would like to illustrate this using the example of the del credere.

The del credere is usually calculated at a flat rate, based on the specifications of the respective tax administration. In addition, an estimate is made of the default risk for overdue receivables. If this assessment is lower than the flat-rate allowance or even zero, the difference between the two amounts is a hidden reserve. If the assessment is higher than the flat-rate allowance, this is not sufficient and must be increased to the value of the risk assessment. In this case, of course, there is no hidden reserve.